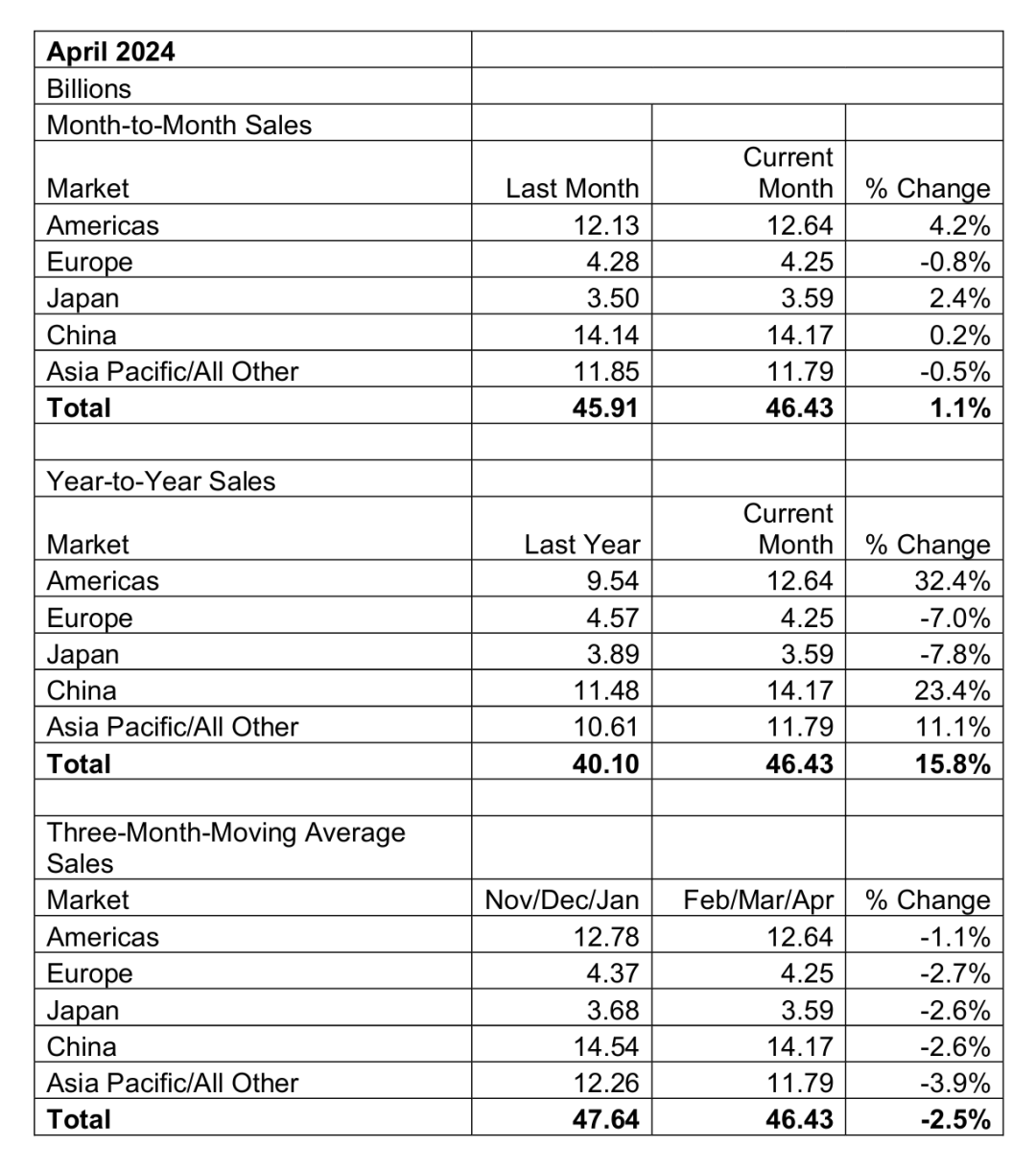

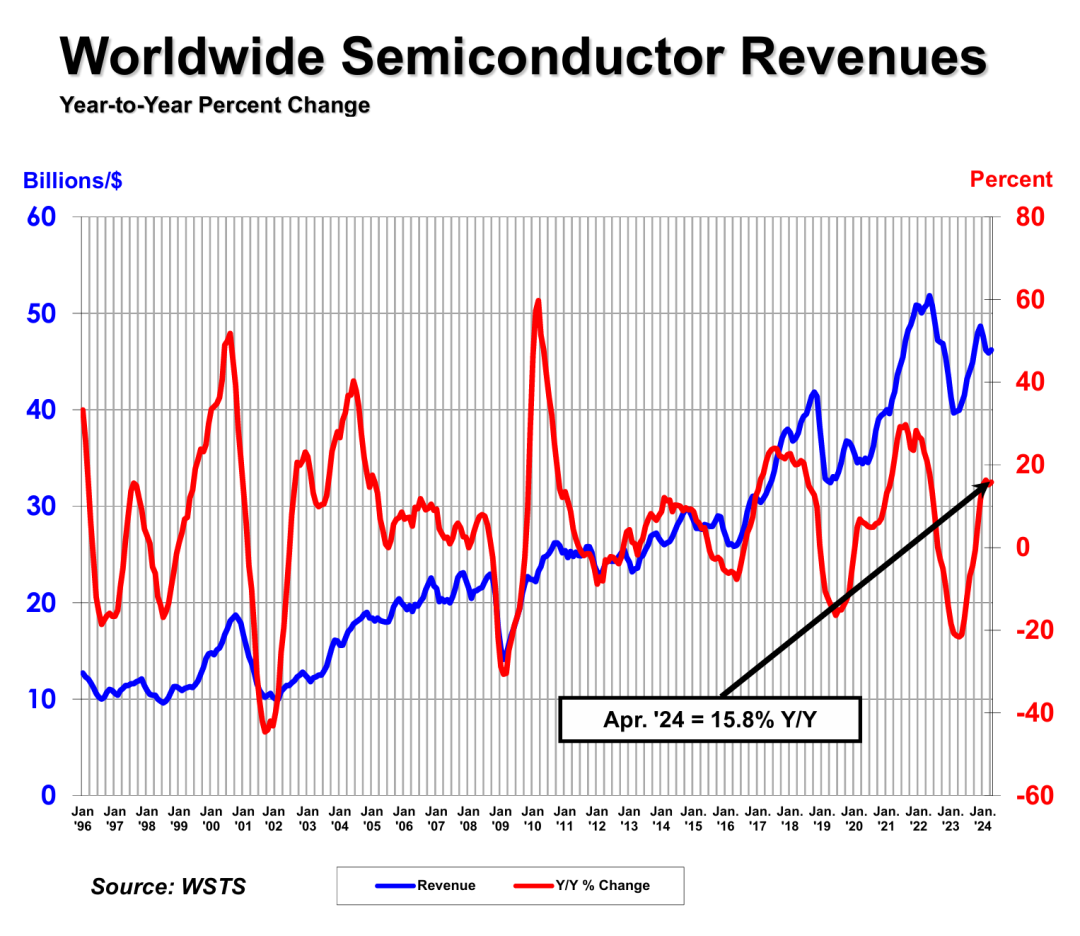

On June 6, SIA announced that global semiconductor industry sales in April 2024 were $46.4 billion, up 15.8% from the total of $40.1 billion in April 2023 and up 1.1% from the total of $45.9 billion in March 2024.

John Neuffer, president and CEO of SIA, said: "Global semiconductor industry sales have achieved double-digit year-on-year growth every month in 2024, and global sales in April increased month-on-month for the first time this year, indicating strong market momentum as the middle of the year approaches.

Regionally, sales in April increased year-over-year in the Americas (32.4%), China (23.4%), and Asia Pacific/All Other (11.1%), but decreased in Europe (-7.0%) and Japan (-7.8%). Month-over-month sales in April increased in the Americas (4.2%), Japan (2.4%), and China (0.2%), but decreased in Asia Pacific/All Other (-0.5%) and Europe (-0.8%).

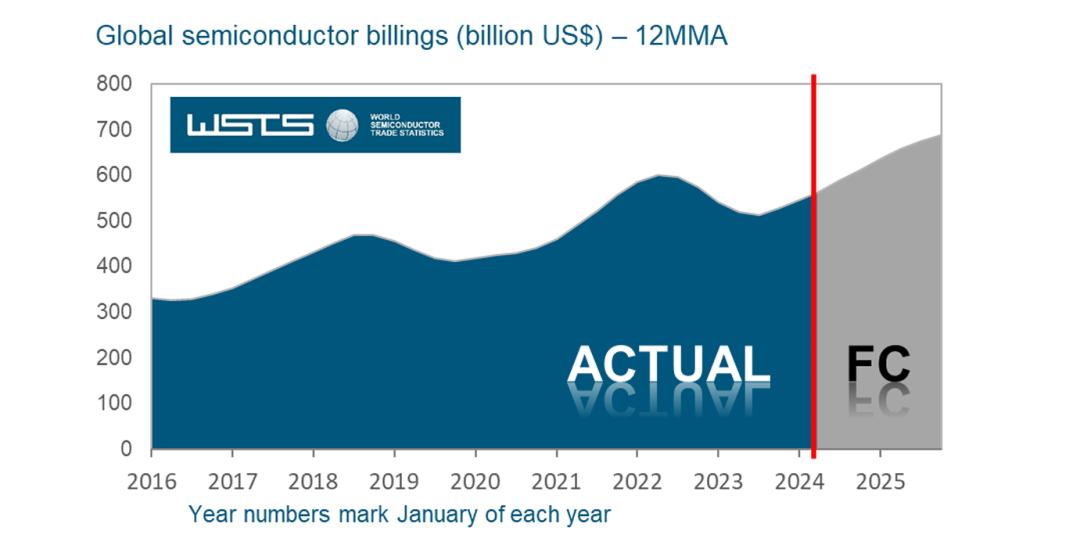

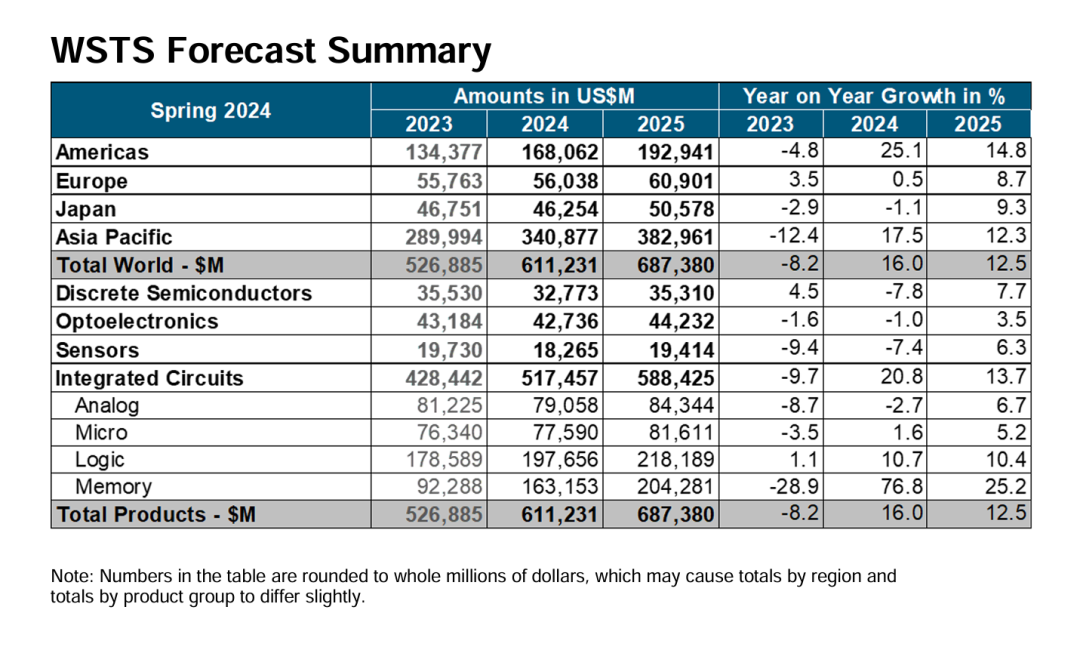

According to the World Semiconductor Trade Statistics (WSTS), strong growth is expected in 2024 and 2025. In 2024, global annual semiconductor sales will increase to US$611.2 billion; in 2025, global sales are expected to reach US$687.4 billion.

Forecast for 2024: Strong recovery

WSTS has raised its forecast for the semiconductor market in the spring of 2024, expecting to achieve 16% year-on-year growth, and predicts that the total value of the global semiconductor market in 2024 will reach $611.2 billion.

This growth forecast is primarily based on the strong performance of the semiconductor market over the past two quarters, particularly in computing end markets.

Logic and memory are expected to achieve double-digit growth in 2024, with logic integrated circuits expected to grow by 10.7% and memory integrated circuits expected to grow by 76.8%.

Other semiconductor product categories such as discretes, optoelectronics, sensors and analog semiconductors are expected to post single-digit declines.

In terms of geographical distribution, the Americas and Asia-Pacific are expected to achieve significant growth, with growth rates of 25.1% and 17.5% respectively; Europe is expected to show only a marginal growth of 0.5%; Japan is expected to experience a slight decline of 1.1% .

Note: The figures in the table are rounded to the nearest million dollars, which may result in slightly different totals by region and by product group

2025 Outlook: Continued Steady Growth

WSTS predicts that the global semiconductor market will achieve 12.5% growth in 2025, and the market valuation is expected to reach US$687.4 billion.

This growth is mainly driven by the memory and logic industries. The memory industry is expected to reach a scale of more than US$20 billion in 2025, and its growth trend is expected to exceed 25%. The logic industry is expected to grow by 10% over the previous year.

Other market segments, such as discrete devices, optoelectronic devices, sensors, and analog semiconductors, are expected to maintain single-digit growth rates.

In terms of geographical distribution, all regions of the world are ready to continue to expand by 2025. Among them, the Americas and Asia Pacific are expected to maintain double-digit year-on-year growth.

Disclaimer: The content of the article comes from SIA, and the publication/reprint is only for communication and sharing. If you have any objections, please contact us in time, thank you.